TG1 lays out antinomy exploration plan

Our micro-cap exploration Investment TechGen Metals (ASX: TG1) just outlined its antinomy work programs.

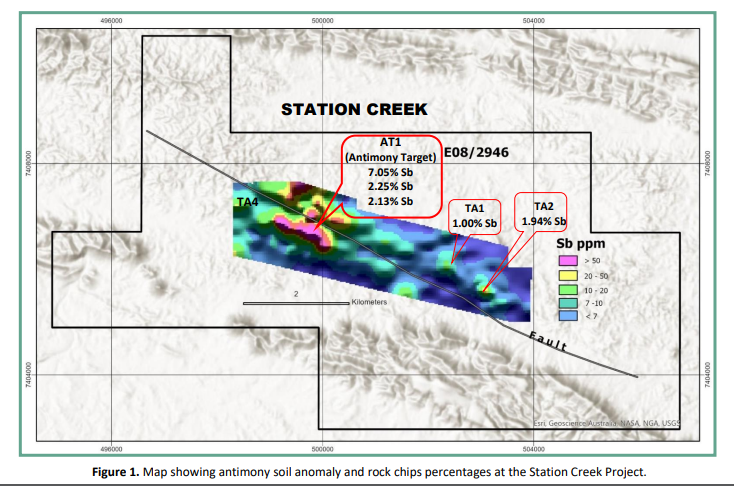

Last week, TG1 put out an announcement highlighting the 7% antinomy rock chips at one of its projects in WA.

The rock chips had been known news for a while - they were disclosed in TG1’s IPO prospectus in April 2021.

After the proposed export bands from China (which supplies almost half of the world’s antimony), the rare commodity is in demand again, and TG1 is going back to review the potential of its project.

So far, TG1 has reviewed old rock chip samples taken from the project, returning grades as high as 7% antimony.

Now TG1 is running additional mapping/sampling and plans to follow it up with soil sampling later this month.

The purpose of the program is to identify antimony-focused drill targets.

It’s still very early for TG1, but the antimony interest in the market has already impacted TG1’s market cap.

Before any antimony news, TG1’s market cap was ~$3.5M.

Last week, TG1’s share price had a bit of a run to ~5c (market cap of ~$6.5M).

Now with TG1 on the ground doing exploration work we are looking forward to seeing what the next few months looks like for TG1.

What’s next for TG1?

Antinomy exploration 🔄

- Mapping/Sampling - likely to see some more rock chip samples taken during this stage of work.

- Geochem work - This will likely involve some soil sampling along with the rock chip samples.

Gold drill results 🔄

TG1 recently finished a second round of drilling at its WA gold project.

Drilling finished on the 30th of July, so we should see assays any day now.

TG1 is following up on a previous 4m thick intercept where gold grades were ~6.73g/t.

TG1 just drilled nine holes to see if that previous hit extends in any direction.

As a result, our bull, base & bear case expectations for the drill program are as follows:

- Bull case = Extensions to the 4m intercept with gold grades above 2g/t

- Base case = Extensions to the 4m intercept with gold grades between 1g/t and 2g/t

- Bear case = No extensions or gold grades <1g/t

Copper geophysics 🔄

TG1 recently picked up its copper assets in WA…

The projects are relatively early stage but have had high grade rock chips grading up to 50.5% and, interestingly, had never been explored for copper before.

Interestingly, the projects hadn't even had any geophysical surveys done on them.

Currently, TG1 is running geophysical surveys across those assets to rank some drill targets.

We are looking forward to that news, and IF TG1 can put out any interesting drill targets, we expect to see investor interest come back into TG1.

Especially considering the huge investor demand (and lack of supply) of high risk/high reward copper explorers on the ASX.